THANK YOU - YOUR FREE REPORT IS BELOW

The Holy Grail of High Return Tech Investments

Dear reader,

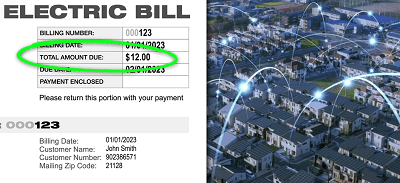

This $10 Stock is set to trigger a $7 trillion market by 2050

It’s not artificial intelligence, electric vehicles or 5G. In fact, it’s set to grow faster than all those industries.

The tech industry is a pivotal sphere in our world today.

There is hardly any sphere of human influence, and modern economy that technology does not play a pivotal role. Many sectors rely on technology to boost productivity, quality, and profitability.

This is why the tech industry enjoys huge attention and wide acceptability.

Investors recognize the technology industry as a "fertile ground" for investors.

Thus, the technology industry has risen to become one of the largest investment opportunities in the world today.

The tech industry is arguably the largest single sector of the market, which includes other industries and, more importantly, the financial sector.

Notably, above anything else, technology firms are usually related to witty inventions and innovation.

Thus, investors usually project a huge amount of expenditure on development, research, and innovation by the technology firms.

Similarly, investors are assured of a smooth and steady boost of income propelled by an influx of new innovative ideas, features, products, and services.

Generally, tech investment may include shares, which are stocks in organizations in the technology industry — a massive sector comprising IT, electronics, computer software and hardware, and telecommunications.

Notably, tech investment provides a potentially high growth rate.

However, you will agree that, like other high returns investments, there are some high risks too.

One feature of the tech investment sphere is that tech stocks are usually very expensive.

However, potential can invest in tech-based mutual funds and ETFs. This kind of investment can minimize the potential high-risk rate.

The tech industry is big, covering sectors like telecommunications, IT, computer systems, semiconductors, industrial electronic equipment, hardware, software program, and data generation offerings.

Tech investments do not only have to do with tech giants; investments have a high growth rate in innovative tech startups.

These investment shares have furnished investors with huge returns during the last few years and hit all-time highs in 2020.

The Significance of Tech Investment

Though tech investments bring high risks, they also promise an appreciably high income and profit growth rate.

This has been the triumphing trend for many years now.

However, in the larger part of the twenty-first century's bull marketplace, tech investments have been at the front burner, with the largest tech shares all outperforming the S&P 500 during the last 5 and 10 years.

Notably, the foremost organizations in the S&P 500 are all a part of the tech area: they include the following:

- Amazon

- Apple

- Alphabet (Google)

- Microsoft

Research shows that total investments in these notable tech companies alone can account for 18% of the overall marketplace capitalization of the S&P 500 at the beginning of 2020.

Susannah Streeter, a senior funding and marketplace analyst with Hargreaves Lansdown, noted, "The tech area has done very strongly at some point of the pandemic, improving from the surprise plunge in March 2020 to attain new report highs."

Notably, there's an essential reason why tech investments draw more investors' demand than other varieties of equities.

This is because the tech industry is futuristic and promises the invention and delivery of new products, services, and features.

Moreover, the behavioral modifications COVID-19 introduced are the most effective acceleration of virtual trends already sweeping the economy.

This has boosted the optimistic view that tech investments already have huge gains and will be a more secure longer-time bet.

Sectors of High-Rate Tech Investment

The following sectors are areas of high-rate tech investments. These tech sectors may, however, be valued in diverse ways. The following are the major sectors.

Strange Space Device Next Medical Miracle?

Used on board SpaceX Dragon, one device could change medicine forever... and give early investors a chance at life-changing gains!

See the Shocking Device - Click Here Now

1. Software

This sector typically refers to commercial and enterprise software; however, it may cover consumer software programs and apps.

The most common examples are Microsoft, SAP, Salesforce, Adobe, Oracle, and VMware. Investments in this sector are enjoying growth of almost 50% or above.

Software investments have been around for quite a while, and they are still very much relevant in the modern era as they serve different purposes powering innovations, including novel areas like Artificial Intelligence (AI).

2. Tech Hardware

This sub-area covers organizations that manufacture computer systems, patron electronics, clever devices, and some other pieces of virtual hardware you would possibly want in the 21st century.

This includes a router, printers, etc. Apple, Samsung, Dell, Sony, Panasonic, HP, and Lenovo are most notable, with Apple growing by over 80% in 2019-20 and Sony growing by around 48%.

3. Semiconductors

This class refers to shares of organizations that manufacture the semiconductors, chips, and different inner hardware utilized by computing devices.

Notable examples include Intel, Taiwan Semiconductor Manufacturing Co., Qualcomm, Broadcom, Micron Technology, and Texas Instruments. Taiwan Semiconductor Manufacturing Co. and Qualcomm have each risen by over 60% in 2019-20, while Broadcom and Texas Instruments have risen by over 20%.

4. Networking and Internet

Networking, excellent and small, is arguably the most important tech innovation since the microchip.

The introduction of networks has not only significantly improved performance within organizations, but the net itself (one massive network) has facilitated major adjustments to trade and has underpinned entirely new business fashions like cell banking and software as a service (SaaS).

In many respects, networking is a sub-region of the alternative mega-sectors; it calls for hardware (chips) and software programs to function. That said, it's far huge sufficient, and vital to face on its own.

Broadly speaking, traders can divide their interest among those organizations focusing on the purchaser (B2C, business-to-consumer) and those that focus on "behind the scenes" enterprise performed among businesses (B2B, business-to-business).

In many cases, though, organizations like Amazon, Meta (previously Facebook), and Google severe those lines.

In 2017, U.S. retail e-commerce alone was projected to be worth something in the community of $450 billion a year in revenue, which no longer encompasses the fee from the digital budget transfer, marketing, facts interchange, or online delivery chain management.

5. Hardware

Hardware no longer gets the equal amount of appreciation it enjoyed in earlier decades.

However, it is nevertheless a key part of the technology world.

Although the software is more replicating the features of many hardware parts, there may still be a primary marketplace for various hardware, and the sector isn't always as out of date as many believe.

Company-extensive networks and the internet only work due to a big spine of equipment and software is still simply a set of fixed instructions; there must be a "something" to be instructed and to perform those instructions.

Computers have advanced into a beautiful array of gadgets ranging from self-riding automobiles to cell gadgets that may reflect and replace a few functions of personal computer systems.

In addition, new thrilling products, including virtual reality headsets and wearables, can revolutionize customer hardware.

At the same time, the extreme user needs for information technology can propel ongoing innovation in routers, servers, and data storage gadgets.

To be more specific, hardware may be divided into sub-sectors, including communications equipment, computers and peripherals, networking equipment, technical instruments, and consumer electronics.

Unfortunately, investors may find some of these segments arbitrary or incomplete; do advanced electronic defense systems belong in the traditional aerospace/defense category, or are they generation hardware?

Consequently, investors should not depend too much on labels while identifying what's or isn't always considered "hardware."

6. Telecommunications

Telecom consists of organizations involved in phone networks, broadband networks, etc.

The most notable examples are AT&T, Deutsche Telekom, Nippon Telegraph, Verizon, and Telephone Corp.

This is another viable tech industry sector with high investment values.

Moreover, the telecommunication niche works integratively with the overarching tech innovation as digital communication is an important part of these devices.

This strong role of telecommunication makes it another strong sector that is not going away and delivers on high-yield investment.

The World’s First Quadrillion-Dollar Tech?

Forget Area 51…

Forget alien invaders…

Forget every report of a UFO sighting…

Let’s go 1,700 miles east to “Area 52”...

Where a godlike super-technology is undergoing top-secret government tests.

Although it may look like alien technology… Amazon, Goldman Sachs, and Verizon stand ready to strike it rich, as they’re among the technology’s earliest adopters.

Things You Should Look Out for Every Tech Investment

1. Potential for High Growth

The technology company you want to invest in must address a large or growing market opportunity.

You must clearly understand the target market's customer segments and competitive landscape in the target market(s).

Your potential investment company must have a sustainable competitive advantage.

Thus, the company must have few large competitors or well-funded new entrants already in the target market.

As an investor, you must seek a business model that will provide a sustainable advantage for the business and its customers.

2. The financial Return On Their Investment (ROI)

The prospective investment company must have developed a sound financial plan demonstrating how the company will make profits and some reasonable strategies on how the investors will receive a cash return on their investment.

Of course, this must be supported by the valuation and terms of the current investment round that the business is asking you to consider.

Your potential investment company must have a sustainable competitive advantage.

Thus, the company must have few large competitors or well-funded new entrants already in the target market.

As an investor, you must seek a business model that will provide a sustainable advantage for the business and its customers.

Best Time to Buy Tech Stocks Since 2000 (And the #1 Bargain Now)

After the tech bubble popped in 2000, there were some amazing bargains available…

You could get Amazon for just $6!

I believe this time is no different.

With the recent tech sell-off, there are some incredible companies trading at discounts we’ll never likely see again in our lifetimes.

And I believe I have the name of the #1 bargain right now.

This is a tiny Silicon Valley company that’s using AI to do something incredible.

2. Organized and Strong Leadership

As an investor, it is important to ensure that the company's team includes people who are leaders in their field.

In addition, they must have a customer focus and understand the specific sub-segments of the target market.

Ideally, the senior team should consist largely of individuals with prior technology startup experience.

Understanding Operations of Potentials Companies

One of the other simple facts about equities is that tech stocks regularly gain better premiums than most other marketplace sectors.

In theory, this excessive valuation stage is the recognition of the above-average boom rates that successful technology businesses post.

In practice, though, even unsuccessful companies can deliver sturdy valuations right up until the point where the marketplace offers up those increased prospects.

As an investor, you must understand that technology has many public businesses that do not yet produce profits or cash flow.

The absence of a report forces investors to apply more guesswork when building discounted cash flow valuation models.

Investors can take a little encouragement from the fact that research and diligence pay off in the tech region.

Understanding a corporation's products (specifically their benefits and disadvantages) and those of its competitors can produce an investable edge.

Clearly, that is an area where the information matters.

Whether or not, as investors, you must concern yourselves with valuations in the tech region is a subject of ongoing debate.

But, on the other hand, investors who are not so nimble, as they believe or misjudge the competition, find themselves maintaining very high-priced stocks without an underpinning of value to guide them.

The Top Tech Stocks That You Can Invest In

The technology sector comprises businesses promoting items and offerings in electronics, software programs, computers, artificial intelligence (AI), and other industries associated with Information Technology (IT).

The sector consists of big tech firms with the most important marketplace capitalizations in the world, including Apple Inc., Microsoft Corp., and Amazon.com Inc.

Tech shares, represented with the aid of using the Technology Select Sector SPDR Fund (XLK), have barely outperformed the wider marketplace over the last 12 months.

Nevertheless, XLK has furnished traders with a total return of -10.1% over the last 12 months, above the Russell 1000's total return of -11.6%.1. The following are the foremost 5 tech stocks with great value, quickest growth, and maximum momentum.

There are several licensed brokers to pick from, and your choice of a broker is based on your priorities and needs. There are three key options to consider when choosing a broker:

Is Amazon Using Alien Technology?

Forget Area 51… Let’s go 1,700 miles east to “Area 52”...

Where a godlike super-technology is undergoing top-secret government tests.

Although it may look alien… Amazon stands ready to strike it rich, as it’s among the technology’s earliest adopters.

It’s also my top investment for this year — packed with enough potential to turn a modest $2,500 into $225,000.

Investors Should Be Wary of Techlash

Even though tech is at risk of interference from government authorities as tech is a main focal point for regulators and lawmakers in the U.S. and every other jurisdiction.

Recently, the U.S. placed a stronger grip on the law of technology exports to prevent China and other key international stakeholders from acquiring unique technology.

The most current example is the possibility of the U.S. banning TikTok, a popular social media app amongst teens, because of the fear of Chinese authorities' interference.

Experts have stated that investors should absolutely continue to brace for a techlash, as regulators and governments aren't yet done with tightening regulation around tech firms that have, historically, taken advantage quite aggressively of limited rules in a bid to win customers, reduce tax burdens and outmaneuver governments.

Conclusion

While no one can necessarily assure that big tech stocks won't suffer volatility and dips, their growth may likely outweigh any losses in the long term.

Investors looking to build a varied portfolio need to significantly keep in mind adding them to their asset mix.

They offer returns that are not certainly matched by any other kind of stock.

Investors who want the highest appreciation would devote a section of their holdings to tech shares.

Aside from their humongous returns, tech investments have exhibited more futuristic potential than conventional investments that are prone to a significant decline in the coming years.

Therefore, it is a good and worthy investment option to invest in the future that you are guaranteed who yield more results.

Resources and References:

-

Things you Should Look Out for in Every Tech Investment

https://learn.marsdd.com/article/what-investors-look-for-in-a-technology-investment/

-

Things you Should Look Out for in Every Tech Investment

https://learn.marsdd.com/article/what-investors-look-for-in-a-technology-investment/

Best Value Tech Stocks

https://www.bankrate.com/investing/best-performing-tech-stocks/

-

How to Invest in Tech Stocks

https://www.livewiremarkets.com/wires/investing-in-the-holy-grail-of-tech

https://money.usnews.com/investing/investing-101/articles/what-to-know-about-tech-investing

hello@moneyexplore.com | 265 Hackensack St Unit #1064, Wood Ridge, NJ 07075.

*This manual is for informational and entertainment purposes only. The author is not an investment adviser, financial adviser, or broker, and the material contained herein is not intended as investment advice. If you wish to obtain personalized investment advice, you should consult with a Certified Financial Planner (CFP). All statements made in this manual are based on the author's own opinion. Neither the author or the publisher warrants or assume any responsibility for the accuracy of the statements or information contained in this manual, and specifically disclaims the accuracy of any data, including stock prices and stock performance histories. No mention of a particular security or instrument herein constitutes a recommendation to buy or sell that or any security or instrument, nor does it mean that any particular security, instrument, portfolio of securities, transaction or investment strategy is suitable for any specific individual. Neither the author or the publisher, can assess, verify, or guarantee the accuracy, adequacy, or completeness of any information, the suitability or profitability of any particular investment or methodology, or the potential value of any investment or informational source. READERS BEAR THE SOLE RESPONSIBILITY FOR THEIR OWN INVESTMENT DECISIONS. NEITHER THE AUTHOR OR THE PUBLISHER IS RESPONSIBLE FOR ANY LOSSES DUE TO INVESTMENT DECISIONS MADE BASED ON INFORMATION PROVIDED HEREIN. At the time of writing, neither the author or the publisher has a position in any of the stocks mentioned in this manual. By proceeding with reading this course, you affirm that you have read and understand the above disclaimer.

Disclaimer - Forex, futures, stock, and options trading is not appropriate for everyone. There is a substantial risk of loss associated with trading these markets. Losses can and will occur. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system or the information in this presentation will generate profits or ensure freedom from losses.HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.